In the dynamic landscape of entrepreneurship, securing adequate funding remains a pivotal challenge for startups. While traditional funding avenues like venture capital and bank loans have long been the norm, a paradigm shift is underway as entrepreneurs increasingly explore alternative financing models. Let’s delve into the realm of innovative financing options for startups, shedding light on diverse approaches beyond the conventional:

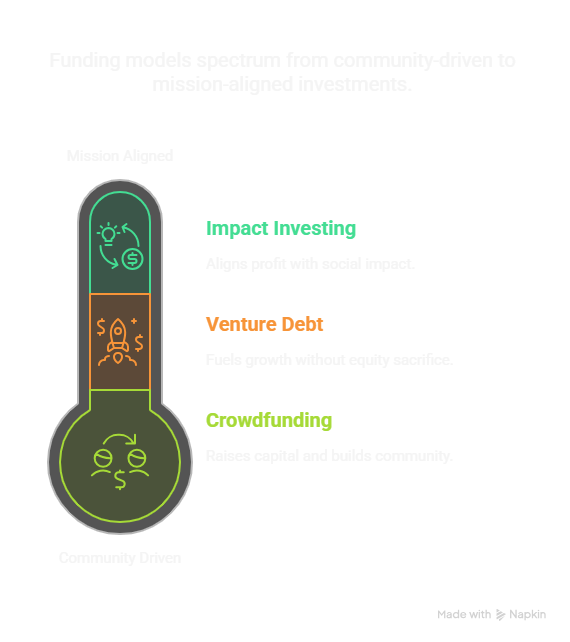

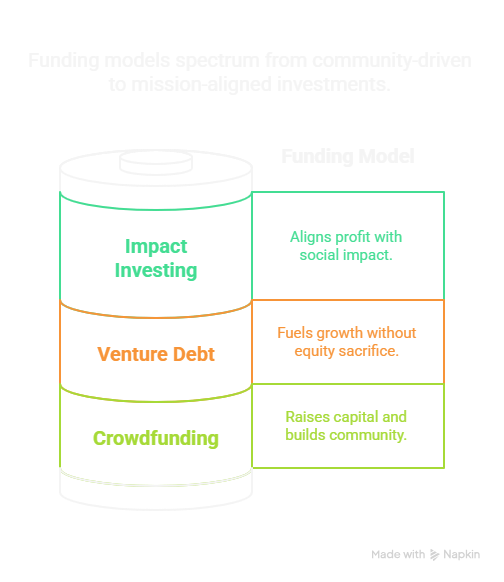

Crowdfunding: A Collective Approach to Fundraising

- What Is It?: Crowdfunding has emerged as a game-changer for startups seeking capital while simultaneously building a community of supporters.

- How It Works: Platforms like Kickstarter and Indiegogo allow entrepreneurs to showcase their projects to a global audience, enticing individuals to contribute small amounts of money in exchange for early access or exclusive perks.

- Benefits:

- Democratization of Funding: Crowdfunding injects capital into ventures while validating market interest directly from future customers.

- Bypassing Gatekeepers: Startups gain direct support without relying solely on traditional gatekeepers.

- Success Story: Pebble Time smartwatch shattered crowdfunding records by raising over $20 million on Kickstarter, exemplifying the power of the crowd.

Venture Debt: Balancing Risk and Growth

- What Is It?: Venture debt is an alternative to equity financing, allowing startups to raise capital without diluting ownership.

- How It Works: Unlike traditional loans, venture debt often includes equity kickers or warrants, allowing lenders to share in the company’s success.

- Benefits:

- Rapid Growth: Attractive for startups aiming to fuel growth without sacrificing equity stakes.

- Strategic Leverage: Companies like Tesla and SpaceX have used venture debt strategically to navigate financial challenges while maintaining control.

- Lesson: Balancing debt and equity is crucial for a well-rounded financing strategy.

Impact Investing: Profits with a Purpose

- What Is It?: Impact investing prioritizes both financial returns and positive societal or environmental impact.

- How It Works: Impact investors actively seek startups aligned with their values, viewing profitability as a means to fund social and environmental initiatives.

- Benefits:

- Symbiotic Relationship: Profit and purpose coexist, making impact investing compelling for socially conscious entrepreneurs.

- Example: Warby Parker combines business success with providing glasses to those in need, attracting impact investors and brand loyalty.

In summary, innovative funding models go beyond the traditional venture capital route. Whether through crowdfunding, venture debt, or impact investing, entrepreneurs can strategically access capital while staying true to their mission.